Green Vault Holding provides resilient, future-ready infrastructure and sustainable investment solutions across Europe.

![[background image] of rooftop with skyline (for a roofing contractor)](images/0_0.jpeg)

Green Vault Holding strategically targets sectors pivotal to the global economy, emphasizing technological innovation, environmental sustainability, and critical infrastructure development. Its investment approach centers on identifying opportunities where innovation aligns with essential needs, focusing on long-term trends and undervalued assets. Explore the six core investment pillars by selecting each card to gain insights into GVH's methodology and market perspectives.

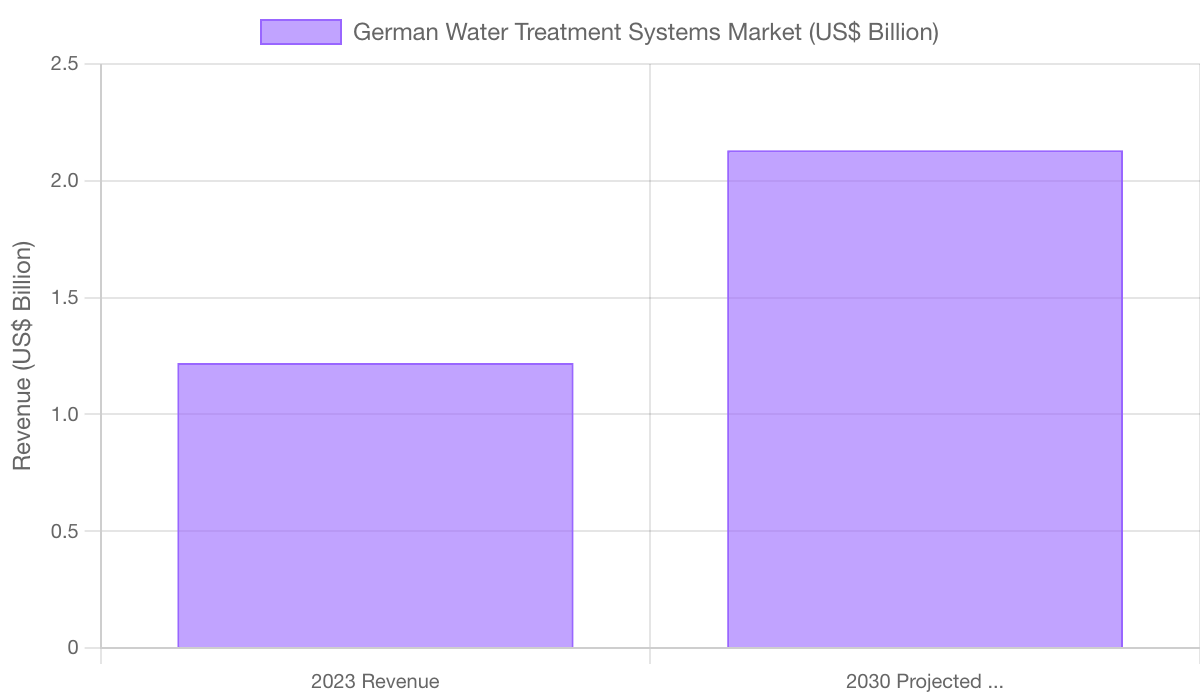

Water is a human right and a strategic asset. We invest in innovative water treatment technologies, infrastructure for clean water delivery, wastewater recycling systems, and advisory services in global water policy and governance. Our mission is to ensure water security through technology, expertise, and ethical investments.

Germany's water treatment systems market is projected to grow from $1.22 billion in 2023 to $2.13 billion by 2030, reflecting a compound annual growth rate (CAGR) of 8.2%. This growth is driven by climate change adaptation, progressive policies, and the integration of digital technologies.

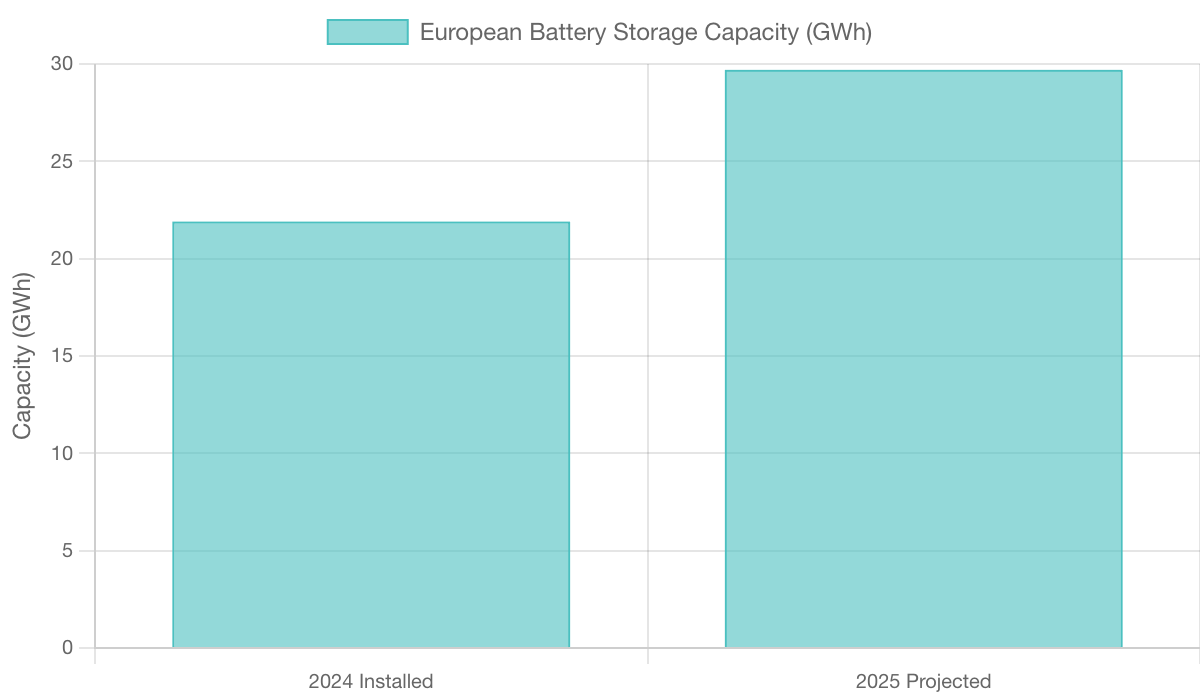

At the core of the global energy transition lies the need for robust, scalable storage solutions. GREEN VAULT HOLDING invests significantly in next-generation battery storage systems that facilitate renewable energy integration, enhance grid stability, and bolster energy resilience. We view energy storage not merely as a utility asset but as a strategic infrastructure pillar.

The European battery storage market is undergoing a significant shift toward large-scale utility systems, projected to drive approximately 40% average annual growth between 2025 and 2029. This trend directly supports strategic priorities for grid stability and enhanced renewable energy integration.

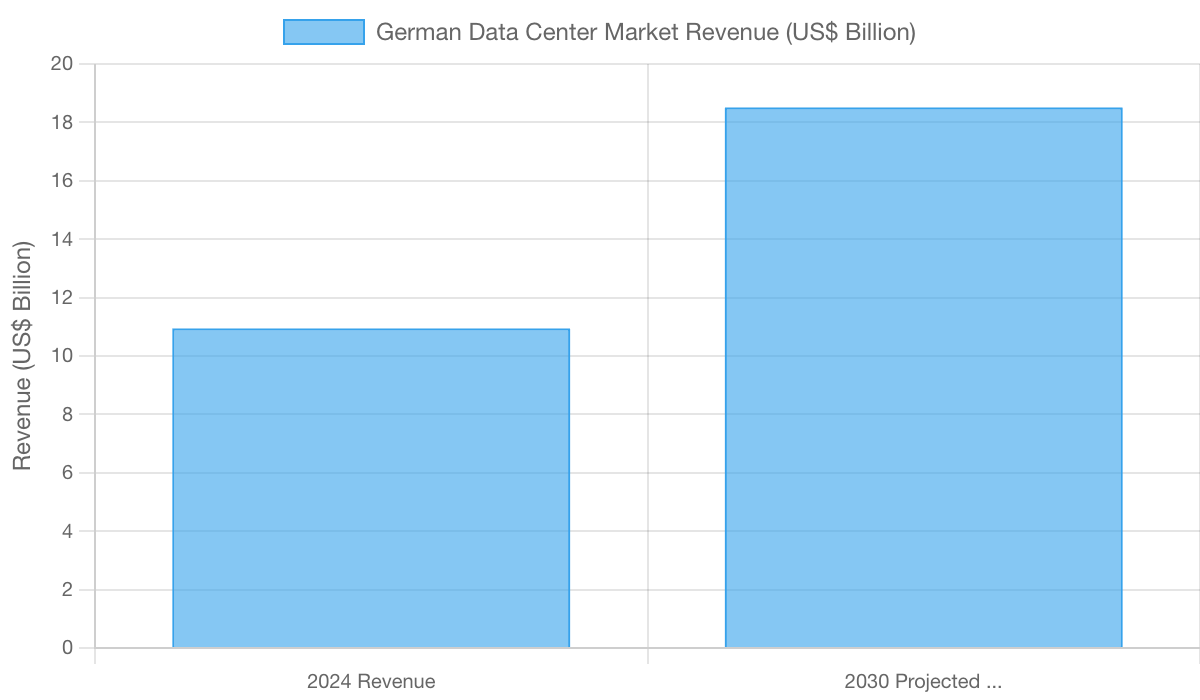

Data is the new oil, and data centers are the refineries. We focus on investments in state-of-the-art data centers that are secure, energy-efficient, and scalable. Our approach prioritizes green data center development with low PUE, modular architecture, and integration with renewable energy and heat recovery systems.

Germany's data center market is poised for significant growth, with revenues projected to increase from USD 10.94 billion in 2024 to USD 18.51 billion by 2030, reflecting a 9.3% CAGR. Stringent sustainability mandates, including the requirement for 100% renewable energy usage by 2027, are key growth drivers.

The future is connected and intelligent. We invest in the convergence of artificial intelligence, telecommunications infrastructure, and internet technologies. Our portfolio includes startups and established companies developing 5G/6G infrastructure, AI-driven applications, and next-generation internet protocols.

Europe's Technology, Media, and Telecom (TMT) sector holds the potential to generate an additional $800 billion in value by 2030. Closing infrastructure gaps will require over $130 billion in annual investments. Policy initiatives such as the Digital Europe Programme are driving AI integration and accelerating 5G adoption.

Our world relies on invisible lifelines. From transportation and power grids to logistics and healthcare networks, critical infrastructure supports every aspect of modern life. We invest in both traditional and impact-driven infrastructure projects that address social, environmental, and economic challenges.

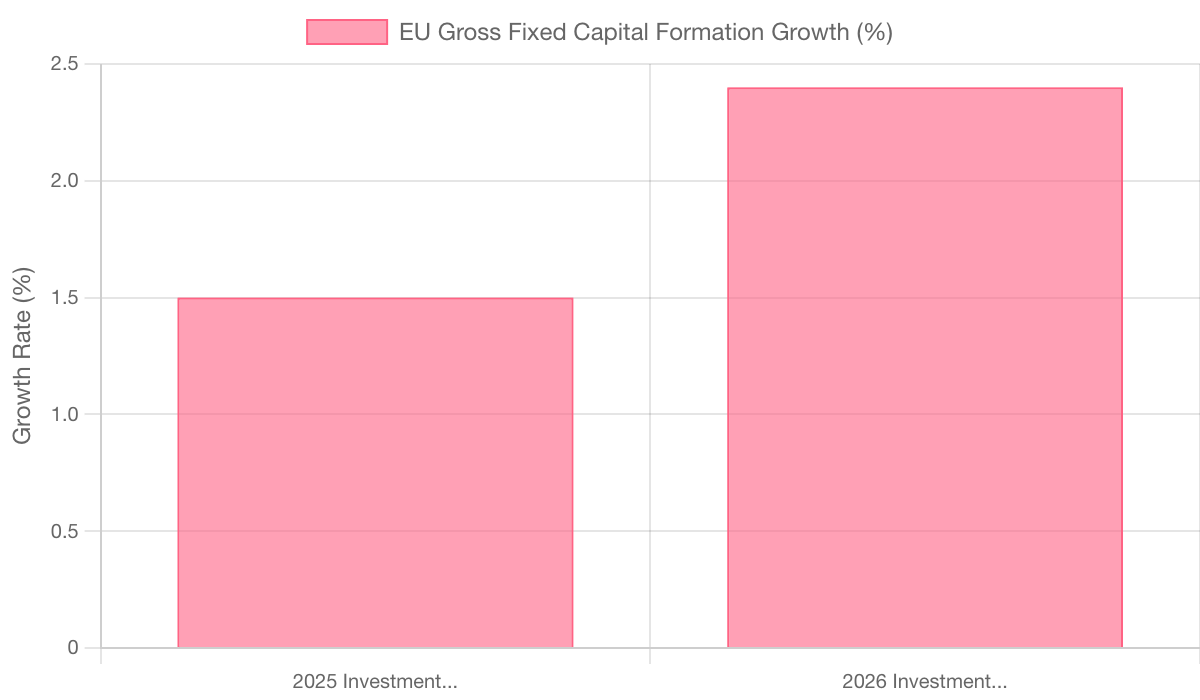

Europe's green transition demands substantial infrastructure investment. A rebound is expected, with 1.5% growth projected in 2025 and 2.4% in 2026, driven by supportive policies and geopolitical stability, making it an attractive destination for long-term capital.

We approach real estate with precision and purpose. GREEN VAULT HOLDING focuses on selective real estate investments, emphasizing mixed-use developments, smart buildings, and energy-efficient housing in key urban locations. Each project is evaluated not just for its yield but for its legacy.

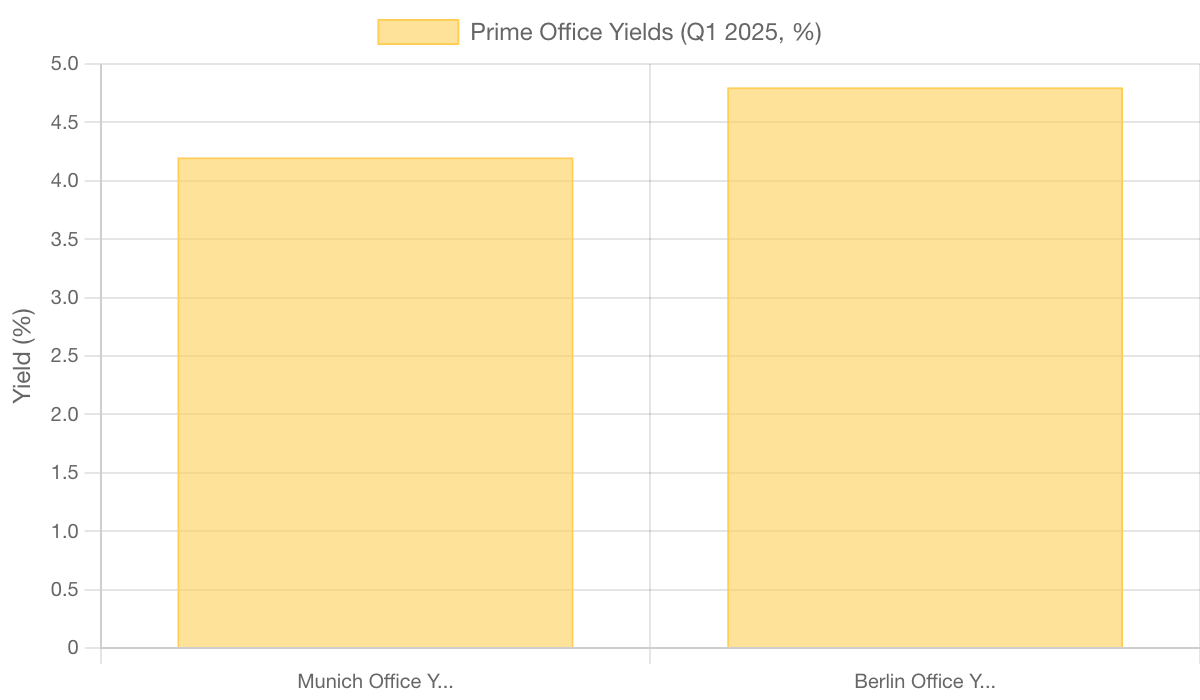

The German commercial real estate market is stabilizing, with prime office yields in Munich at 4.2% and Berlin at 4.8% (Q1 2025). There is increasing value in ESG optimization, smart building technology, and the active management of smaller assets in major cities.